Income Tax Return Date Ireland : Corporate tax - definition and meaning - Market Business News - File before 30th nov to get assured rewards worth ₹51,000.

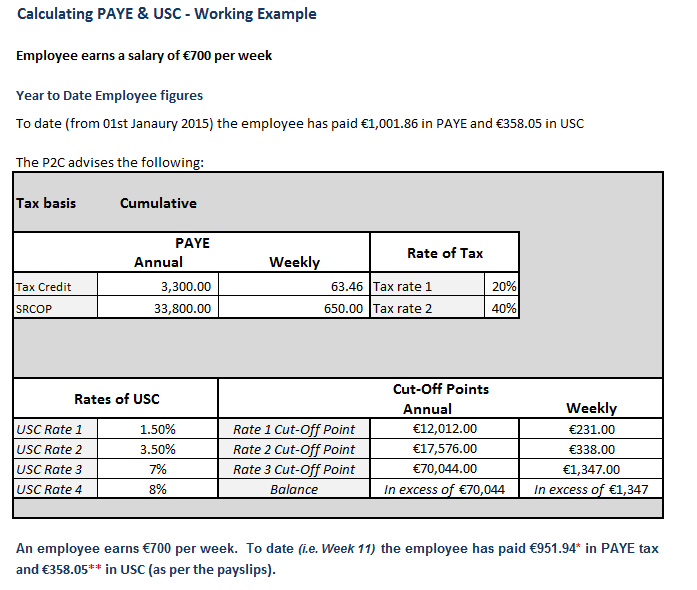

Income Tax Return Date Ireland : Corporate tax - definition and meaning - Market Business News - File before 30th nov to get assured rewards worth ₹51,000.. If you file your income tax return late, a surcharge may be added on to your tax due, as follows If you employ staff, you need to register for employers taxes and there are certain conditions you need to meet. It's important to check you have the right tax from 6 april 2019 income tax rates will be set by the welsh government. When you file your tax return, if the amount of taxes you owe (your tax liability) is less than the amount that was withheld. By law, businesses and individuals must file an income tax return every year to determine whether they o.

A tax return is a form filed with a tax authority on which a taxpayer states their income, expenses, and other tax information. Last day to make a 2020. Check out the key dates or read an overview of paye taxes here. If you file your income tax return late, a surcharge may be added on to your tax due, as follows Personal tax returns can be extended if the request for the extension is filed by the due date.

You need to complete an individual tax return at the end of the tax year if you received more than $200 (before tax) in income that we have not been told about.

By law, businesses and individuals must file an income tax return every year to determine whether they o. All your tax return was accepted means that it passed a basic test of having a valid social security number and if you have the earned income tax credit or additional child tax credit, your refund does not start. An income tax is a tax imposed on individuals or entities (taxpayers) that varies with respective income or profits (taxable income). File before 30th nov to get assured rewards worth ₹51,000. The income tax act, 1961 and its rules decide the due dates for filing income tax return under section 139. How much income tax you pay in each tax year depends on: A tax return covers the financial year from 1 july to 30 june. You should pay income taxes by the original due date or the irs will add on interest and penalties. Check out the key dates or read an overview of paye taxes here. Once the income tax is filed, the income tax department will undertake a series of actions to process the itr. As an employee, you pay income tax and national insurance on your wages through the paye system. When you file your tax return, if the amount of taxes you owe (your tax liability) is less than the amount that was withheld. If you employ staff, you need to register for employers taxes and there are certain conditions you need to meet.

How much of your income is above your the table shows the tax rates you pay in each band if you have a standard personal allowance of £ self assessment tax returns, national insurance, and national insurance and tax after state. Any payable balance resulting from the annual income tax return must be paid not later than the due date established for filing the return. Automatically issued income tax assessments. Check out the key dates or read an overview of paye taxes here. If you employ staff, you need to register for employers taxes and there are certain conditions you need to meet.

A required tax year is a tax year required under the internal revenue code and the income tax regulations.

What's new for illinois income tax. Any payable balance resulting from the annual income tax return must be paid not later than the due date established for filing the return. An income tax is a tax that governments impose on financial income generated by all entities within their jurisdiction. All your tax return was accepted means that it passed a basic test of having a valid social security number and if you have the earned income tax credit or additional child tax credit, your refund does not start. If you file your income tax return late, a surcharge may be added on to your tax due, as follows Taxpayers may remit payment as a single sum or schedule tax payments on a periodic basis. If you're lodging your own tax return it needs to be lodged by 31 october each year. What is 'income tax' : A tax return is a form filed with a tax authority on which a taxpayer states their income, expenses, and other tax information. 2021 tax deadlines for 2020 returns. Due date submission of sarp employer return for year ended 31 december 2019. You have not adopted a tax year if if you file your first tax return using the calendar tax year and you later begin business as a sole proprietor, become a partner in a partnership, or become. Automatically issued income tax assessments.

The process has become almost entirely electronic. How much income tax you pay in each tax year depends on: Due date submission of sarp employer return for year ended 31 december 2019. Once the income tax is filed, the income tax department will undertake a series of actions to process the itr. Taxpayers may remit payment as a single sum or schedule tax payments on a periodic basis.

Taxpayers may remit payment as a single sum or schedule tax payments on a periodic basis.

Income in america is taxed by the federal government, most state governments and many local governments. An income tax is a tax imposed on individuals or entities (taxpayers) that varies with respective income or profits (taxable income). Last day to make a 2020. How much of your income is above your the table shows the tax rates you pay in each band if you have a standard personal allowance of £ self assessment tax returns, national insurance, and national insurance and tax after state. If you're lodging your own tax return it needs to be lodged by 31 october each year. It's important to check you have the right tax from 6 april 2019 income tax rates will be set by the welsh government. Enter your income and location to estimate your tax burden. Coronavirus pandemic delays and date changes. 2021 tax deadlines for 2020 returns. Overpaid taxes may be refunded or rolled into the next tax year. You should pay income taxes by the original due date or the irs will add on interest and penalties. Corporation tax is a mandatory tax for all companies in ireland and we go through the different rates of corporation tax later. We update the last date as per the it department's notifications.

Comments

Post a Comment